-

最新 网信中国网信中国 | 2025-01-24 09:39:40

-

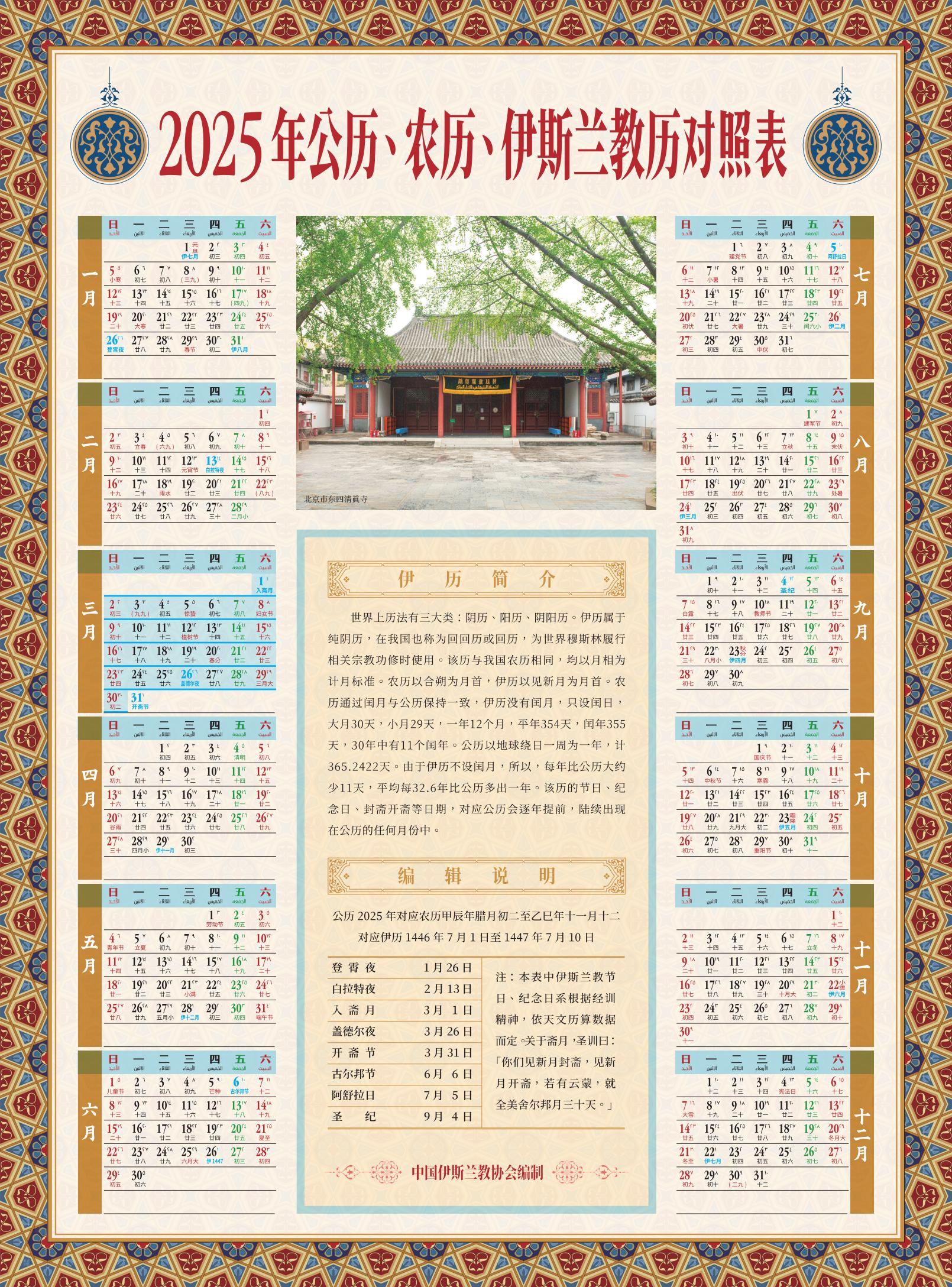

最新 中国伊协在线中国伊协在线 | 2024-10-25 11:10:47

-

最新 穆斯林在线穆斯林在线 | 2024-10-17 05:10:44

-

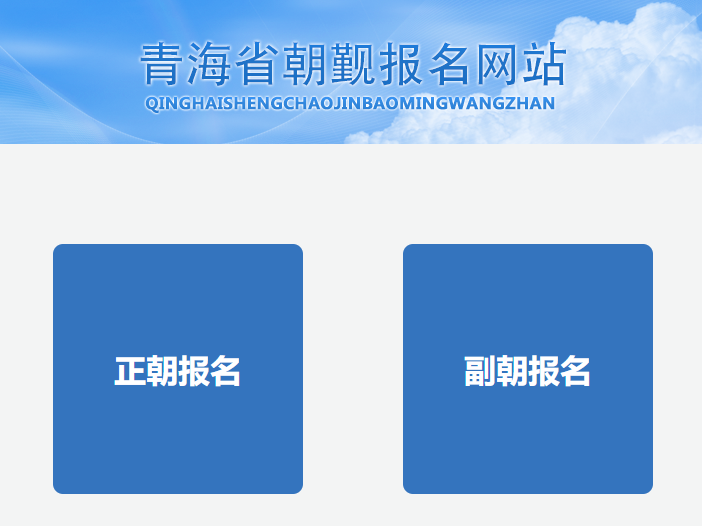

最新 青海省朝觐报名网青海省朝觐报名网 | 2024-08-19 11:38:27

-

最新 中国伊斯兰教协会中国伊斯兰教协会 | 2024-07-23 03:33:23

-

最新 中国伊协|0中国伊协|0 | 2024-06-06 05:10:30

-

最新 国家宗教事务局|0国家宗教事务局|0 | 2024-06-06 02:09:10

-

最新 中国伊协在线|0中国伊协在线|0 | 2024-06-06 07:53:15

-

最新 华夏时报网|0华夏时报网|0 | 2024-06-06 07:52:58

-

中国伊协|0 | 2024-06-06 05:10:39

-

阿语星空|0 | 2024-06-06 08:22:45

-

|0 | 2024-06-06 08:22:45

-

伊光|0 | 2024-06-06 08:22:45

-

2024-06-06 07:54:24

-

2024-06-06 07:50:43

-

2024-06-06 08:40:28

-

2024-06-06 08:40:27

-

2024-06-06 08:40:27

-

凉棚的客人|0 | 2024-06-06 08:26:01

-

|0 | 2024-06-06 08:26:01

-

伊光|0 | 2024-06-06 08:26:00

-

|0 | 2024-06-06 08:26:00

-

2024-06-06 08:45:12

-

2024-06-26 09:11:44

-

2024-06-06 08:45:14

-

2024-06-06 08:45:14

-

2024-06-06 08:45:14

-

|0 | 2024-06-06 10:03:36

-

|0 | 2024-06-06 10:03:36

-

|0 | 2024-06-06 10:03:36

-

|0 | 2024-06-06 10:03:36

-

2024-06-06 08:57:25

-

2024-06-06 05:10:45

-

2024-06-06 05:10:44

-

2024-06-06 08:57:31

-

2024-06-06 08:57:30

-

作者赐稿 | 2024-06-06 08:51:09

-

作者赐稿|0 | 2024-06-06 08:51:08

-

作者赐稿 | 2024-06-06 08:51:08

-

作者赐稿|0 | 2024-06-06 08:51:07

-

2024-06-06 07:50:54

-

2024-06-06 10:09:14

-

2024-06-06 10:09:14

-

2024-06-06 10:09:13

-

2024-06-06 10:09:13

-

穆斯林在线|0 | 2024-06-06 09:35:22

-

伊光|0 | 2024-06-06 09:35:21

-

腾讯|0 | 2024-06-06 09:35:36

-

|0 | 2024-06-06 09:35:35

-

2024-06-06 10:18:33

-

2024-06-06 10:18:37

-

2024-06-23 09:20:49

-

2024-06-06 10:10:20

-

2024-06-06 10:10:20

-

新华国际|0 | 2024-06-06 02:10:36

-

中广网|0 | 2024-06-06 02:10:31

-

《科学时报》|0 | 2024-06-06 02:10:22

-

荆楚网|0 | 2024-06-06 02:10:17

-

伊光|0 | 2024-06-06 03:45:19

-

新华社|0 | 2024-06-06 03:43:21

-

穆斯林在线|0 | 2024-06-06 03:26:02

-

|0 | 2024-06-06 05:04:58

-

|0 | 2024-06-06 05:04:57

-

|0 | 2024-06-06 04:59:06

-

义乌市青海商会 | 2025-01-30 03:35:04

-

青海日报 | 2025-01-20 10:08:28

-

海东日报 | 2025-01-20 10:04:00

-

青海拉面海外运营中心 | 2025-01-20 05:46:35

-

义乌市青海商会 | 2025-01-20 07:39:53

-

青海省伊协|0 | 2024-06-06 09:28:00

-

|0 | 2024-06-06 09:28:00

-

中国穆斯林|0 | 2024-06-06 09:27:59

-

穆斯林在线|0 | 2024-06-06 09:27:58

-

中国宗教|0 | 2024-06-06 09:27:58

-

文/薛庆国|0 | 2024-06-06 09:27:57

-

2024-06-06 10:32:24

-

2024-06-06 10:32:24

-

2024-06-06 10:32:24

-

2024-06-06 10:32:23

-

2024-06-06 10:32:23

-

最新| 2024-06-06 10:31:23

-

最新| 2024-06-06 10:31:23

-

最新| 2024-06-06 10:31:23

-

最新| 2024-06-06 10:31:22

-

最新| 2024-06-06 10:31:22

-

最新| 2024-06-06 10:31:21

-

最新| 2024-06-06 10:31:21

-

最新| 2024-06-06 10:31:20

-

最新| 2024-06-06 10:31:18

-

最新| 2024-06-06 10:31:17

-

最新| 2024-06-06 10:31:17

-

最新| 2024-06-06 10:31:17

-

最新 |0|0 | 2024-06-06 10:04:16

-

最新 手边巴黎|0手边巴黎|0 | 2024-06-06 10:04:16

-

最新 |0|0 | 2024-06-06 10:04:16

-

最新 |0|0 | 2024-06-06 10:04:16

-

最新 |0|0 | 2024-06-06 10:04:15

-

最新 |0|0 | 2024-06-06 10:04:15

-

最新 |0|0 | 2024-06-06 10:04:15

-

最新 |0|0 | 2024-06-06 10:04:14

-

最新 |0|0 | 2024-06-06 10:04:14

-

2024-06-06 10:34:34

-

2024-06-06 10:34:34

-

2024-06-06 10:34:34

-

2024-06-06 10:34:34

-

2024-06-06 10:34:33

-

最新| 2024-06-06 10:35:21

-

最新| 2024-06-06 10:35:21

-

最新| 2024-06-06 10:35:20

-

最新| 2024-06-06 10:34:48

-

最新| 2024-06-06 10:34:48

-

2024-06-06 10:06:21

-

2024-06-06 10:06:21

-

2024-06-06 10:06:21

-

2024-06-06 10:06:20

-

2024-06-06 10:06:20

-

最新 西宁非遗|0西宁非遗|0 | 2024-06-06 10:06:43

-

最新 伊光|0伊光|0 | 2024-06-06 10:06:42

-

最新 古建中国|0古建中国|0 | 2024-06-06 10:06:42

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 10:06:42

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 10:06:41

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 10:06:40

-

最新 |0|0 | 2024-06-06 10:06:40

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 09:09:46

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 09:09:46

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 09:09:46

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 09:09:45

-

最新 穆斯林在线|0穆斯林在线|0 | 2024-06-06 09:09:45

-

网络|0 | 2024-06-06 09:37:28

-

穆斯林在线综合 | 2024-06-06 09:37:27

-

喇秉德|0 | 2024-06-06 09:37:26

-

食堂君|0 | 2024-06-06 09:37:26

-

2024-06-06 09:39:26

-

2024-06-06 09:39:26

-

2024-06-06 09:39:26

-

2024-06-06 09:39:26

-

2024-06-06 09:39:25

-

仙桃市政法网|0 | 2024-06-06 09:42:00

-

穆斯林在线综合|0 | 2024-06-06 09:42:00

-

新京报|0 | 2024-06-06 09:41:59

-

环球不知道|0 | 2024-06-06 09:41:59

-

伊光|0 | 2024-06-06 10:02:32

-

伊光|0 | 2024-06-06 10:02:31

-

中国宗教|0 | 2024-06-06 10:02:31

-

中国新闻网|0 | 2024-06-06 10:02:30

-

|0 | 2024-06-06 10:02:30

-

|0 | 2024-06-06 10:02:29

-

伊光|0 | 2024-06-06 09:55:34

-

|0 | 2024-06-06 09:55:34

-

|0 | 2024-06-06 09:55:33

-

|0 | 2024-06-06 08:22:36

-

|0 | 2024-06-06 08:48:22

-

|0 | 2024-06-06 08:48:09

-

穆斯林在线|0 | 2024-06-06 08:29:49

-

|0 | 2024-06-06 09:42:56

-

百家漫谈|0 | 2024-06-06 09:42:56

-

|0 | 2024-06-06 09:42:56

-

|0 | 2024-06-06 09:42:56

-

|0 | 2024-06-06 09:42:55

-

皖西日报|0 | 2024-06-06 09:42:55

-

青海省伊协|0 | 2024-06-06 08:51:08

-

杨兴本阿訇|0 | 2024-06-06 09:55:33

-

沙特签证|0 | 2024-06-06 09:55:33

-

穆斯林在线|0 | 2024-06-06 09:55:32

-

|0 | 2024-06-06 09:55:29

-

穆斯林在线|0 | 2024-06-06 09:55:28